OUR FRESHEST TECH

Introducing:

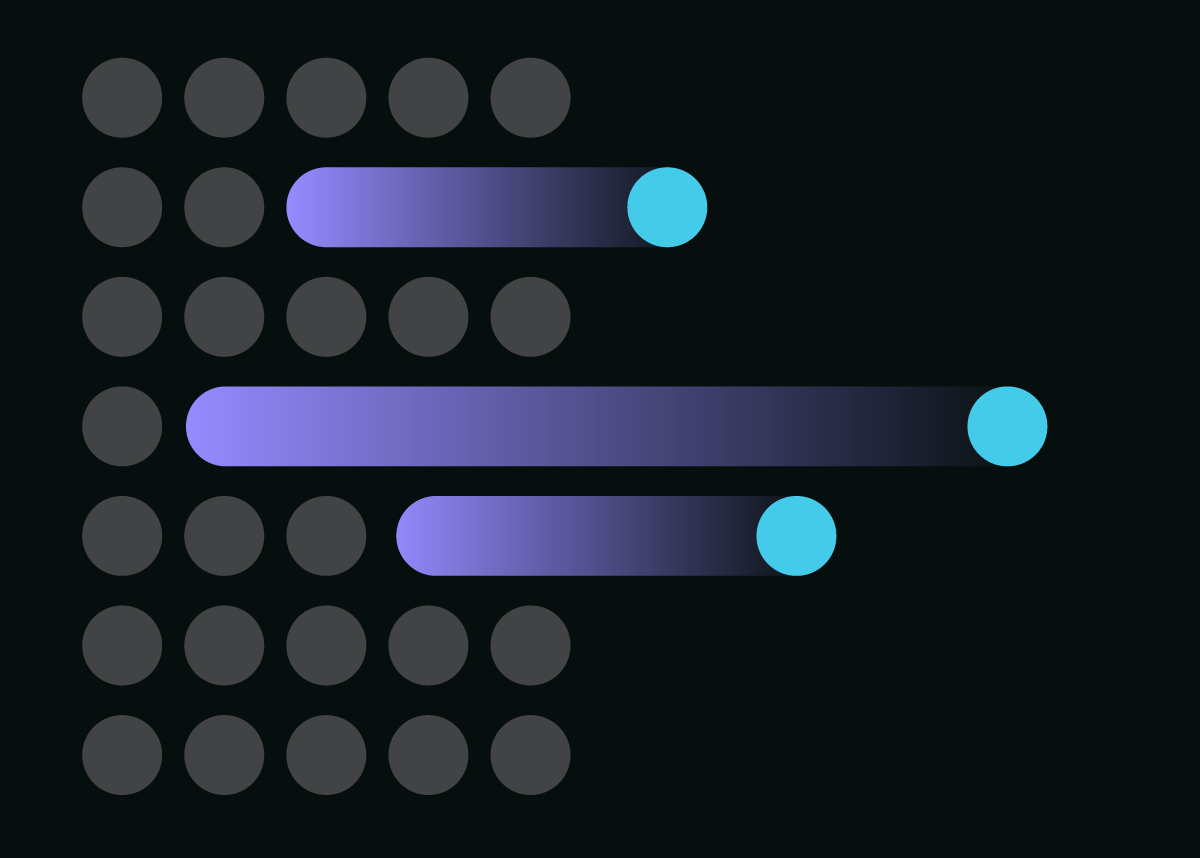

The FUSE Incrementality™ Index

Let’s get specific! A clear view of which affiliate partners are delivering real value.

We’ll help you optimize your spend and maximize your ROI by mapping impact-to-outcome pathways, isolating the touchpoints that drive conversions, and re-focusing your campaigns on the channels and tactics that truly drive growth.

Learn more

Affiliate management for powerhouse brands.

We combine high-level marketing strategy and real-time channel intelligence to keep vital partnerships in motion.

Ready for Impact

Generated Revenue

Spending Leverage

Average ROAS

Of Client Successes

Some of our clients

Perfecting partnerships in motion.

We connect the dots between strategy, technology, and performance to turn automated intelligence into outsized returns.

Formulate

Analysis, Audit and Forecasting, Technology Setup and Testing, Commission Strategy, Content Strategy, Creative Strategy

Launch

Network Activation Program, Marketing, New Publisher Activation, Reporting and Analysis Activation, Compliance Activation

Optimize

Automated Commissions via Fuse, Automated Compliance Alerting Competitive Insights via TopRank, Commission Tuning for New Publishers Placement, Creative Optimization

Widen & Expand

Dynamic Commissions via Fuse, New publishers via Opportunity Discovery, Strategy, Re-Forecasting Lookalike Strategy, New Program Strategy

The custom tech-driven difference.

Our tech-driven services are powered by Control Suite, a custom-built, patented operating system that gives our clients a clear advantage.

Attribution

We align tracking and commissions so you know which partnerships are truly growing your business.

Incrementality

Get clarity on whether your affiliate partnerships are actually driving your incremental revenue.

Sustainable Growth

Calibrate performance tactics with high-level brand strategy to ensure your milestones are in sync with your long-term business goals.

Ready for better?

This form is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.